MONEY

The NFT Economy Is Equally Unequal to the Real Economy

A growing number of studies indicate that a powerful few control the burgeoning market.

The strongest proponents of NFTs, or non-fungible tokens, assert that the decentralized digital universe as a whole, not only the art world, can be made more democratic through the use of blockchain technology. However, a rising body of data indicates that the expanding market is more likely replicating the old order’s structures, where a small but powerful group controls the economy and benefits from it.

For instance, one recent study indicated that “the top 10% of traders alone make 85% of all transactions and trade at least once 97% of all assets,” according to research published in the prestigious science journal Nature. In general, the top 10% of “buyer-seller pairings” are as active as the rest of the group put together. Overall, the data presents a picture of “whales,” or deep-pocketed players in cryptocurrency, virtually controlling the NFT market.

Per one of the researchers, Andrea Baronchelli, “You have a really focused market.”

As the head of the token economy group at the Alan Turing Institute and an associate professor of mathematics at City University of London, Baronchelli said, “The research appears to push back against the arguments typically made that the NFT market is a democratizing and “totally open” economic system where “trade is brought to the masses.”

Between June 2017 and April 2021, the team examined 6.1 million trades of 4.7 million NFTs utilizing 160 different cryptocurrencies. Ethereum and WAX, which advertises itself as an eco-friendly alternative, were the two main cryptocurrencies used.

The study was subject to some restrictions. Data from OpenSea and Decentraland APIs as well as information from NonFungible Corporation, which keeps track of past NFT purchases, were some of the sources the researchers used to compile their findings. T

he paper claims that since information was not directly scraped from the WAX or Ethereum blockchains, “a number of ‘independent’ NFT producers” were “likely missing.” But generally, their data shows that dominant whales currently have a lot of power over these platforms.

A similar conclusion was recently reached by researchers for the data platform Chainalysis when they discovered that “a relatively small set of extremely sophisticated investors rake in most of the earnings from NFT collection.”

Chainalysis examined allowlisting in particular, which permits some privileged users to purchase newly-minted NFTs at a discount, and found that such users made money three-quarters of the time, compared to barely one-fifth of the time for everyone else.

In addition, the researchers from Chainalysis “find possible evidence of the employment of bots by investors aiming to purchase during minting events, which could exclude less experienced users and even result in unsuccessful transactions that cost them in fees.”

While a few NFTs have secured prices that have made headlines, Baronchelli’s team discovered that the industry as a whole appears far less astounding. NFTs connected to the arts often traded for $6,290, and metaverse works normally brought around $9,485. However, in the majority of cases, NFTs only made less than $15, and only 1% of NFTs made more than $1,594.

This widely publicized notion that “Now that the art market has been opened up” Everyone has direct access to collectors, so they can sell their items. This is lovely, but perhaps not very realistic, according to Baronchelli.

Separate analysis have argued that the continued dominance of a small number of traders may be due to the large “gas” fees consumers must pay to execute an Ethereum transaction, such as those made lately by the Constitution DAO movement’s backers. According to a new research note by the digital assets data provider Kaiko, this “prevents more retail traders from accessing” decentralized exchanges, which are markets that operate directly on the Ethereum blockchain and thus charge fees.

Since the WAX blockchain—which accounted for around half of the transactions they analyzed—does not levy gas fees for peer-to-peer trading, Baronchelli said it could have had an impact on his team’s findings but that it did not fully explain what they saw.

Baronchelli went on to state, “This corroborates that concentration may be a genuine attribute of the NFT market at the time.”

Another ongoing issue is wash trading, which is when a trader repeatedly buys and sells a security (or, in this case, an NFT) to influence—and frequently inflate—the market for it. Regulated cryptocurrency platforms like Coinbase, where wash trading has not been found in the past, accounted for less than 1% of all transactions in 2019.

A separate Cornell study found that the practice is more prevalent on unregulated exchanges, which account for more than 70% of all transactions and are excluded from the analysis along with popular sites like Coinbase, Gemini, and Binance. Such concerns were raised by one $500 million NFT transaction on Ethereum in October, in which a trader used a “flash loan” to buy an NFT for themself and then re-list it at a significantly higher price.

Despite the fact that Baronchelli claimed his research does not “prove” wash trading exists, they did find a focused pattern that is “consistent” with such activities as well as money laundering. Thus, the highly unregulated internet financial market risks becoming a breeding ground for the same actions that laws are meant to prevent.

GET FORA IN YOUR INBOX.

THE LATEST

Crime

Turtle With $53 Million Worth of Cocaine Was Found By The US Coast In The Eastern Pacific

Turtle With $53 Million Worth of Cocaine Was Found By The US Coast In The Eastern Pacific In an unexpected …

February 28, 2023

Tech

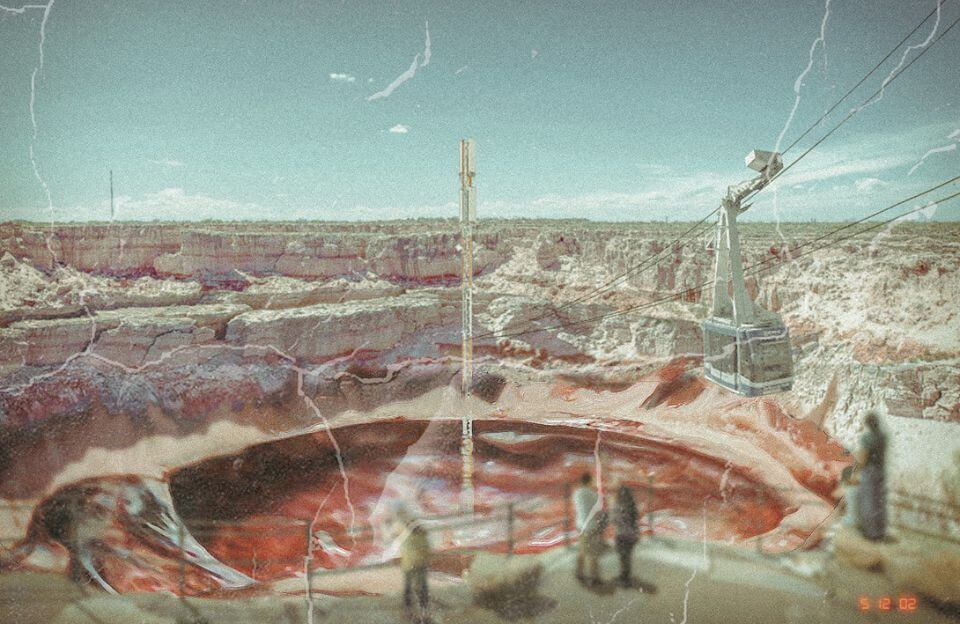

Mysterious Flesh Pit National Park

Mysterious Flesh Pit National Park “Discover verdant forests, majestic scenery, and cosmic terror.” That’s the tagline on this eye-catching poster …

February 22, 2023

Science

How ‘Flat Earthers’ Persist After Being Proven Wrong Over And Over Again

How ‘Flat Earthers’ Persist After Being Proven Wrong Over And Over Again Flat-earthers believe one of the most curious conspiracy …

February 21, 2023

History

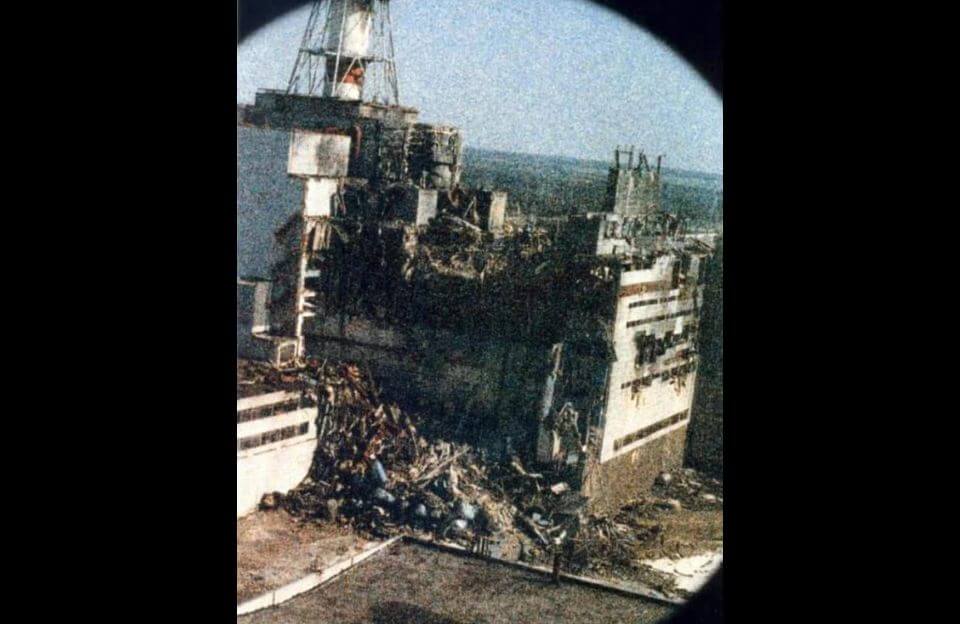

This Is The Only Existing Photo of Chernobyl Taken On The Morning of The Nuclear Accident

This Is The Only Existing Photo of Chernobyl Taken On The Morning of The Nuclear Accident The heavy grain is …

February 20, 2023